Lock your refinance rate: Work with your lender to lock your interest rate when you believe it's the lowest.Ĭomplete a home appraisal: Most lenders require a home appraisal.Ĭlose your loan: Review the closing documents and disclosures, pay any applicable closing costs, and sign. Contact the lender, or find a lender to work with in your area.Īpply for a refinance: Once you apply, your lender will provide you with initial disclosures that outline the terms of the loan. VA loan closing costs average anywhere from 3 to 5 percent of the loan amount, but can vary significantly depending on where you're buying, the lender you're working with, seller concessions and more. Shop refinance rates: Compare different interest rates using the custom rates tool or refinance calculator above to determine if refinancing at a current rate would accomplish your refinancing goals. Like every mortgage, the VA loan comes with closing costs and fees. Select a type of mortgage refinance: You have many refinancing options, including refreshing your rate and term (rate-and-term refinance), applying more cash toward your equity (cash-in refinance), pulling money out of your home equity (cash-out refinance), or opting for a streamline refinance to lower your monthly payments.

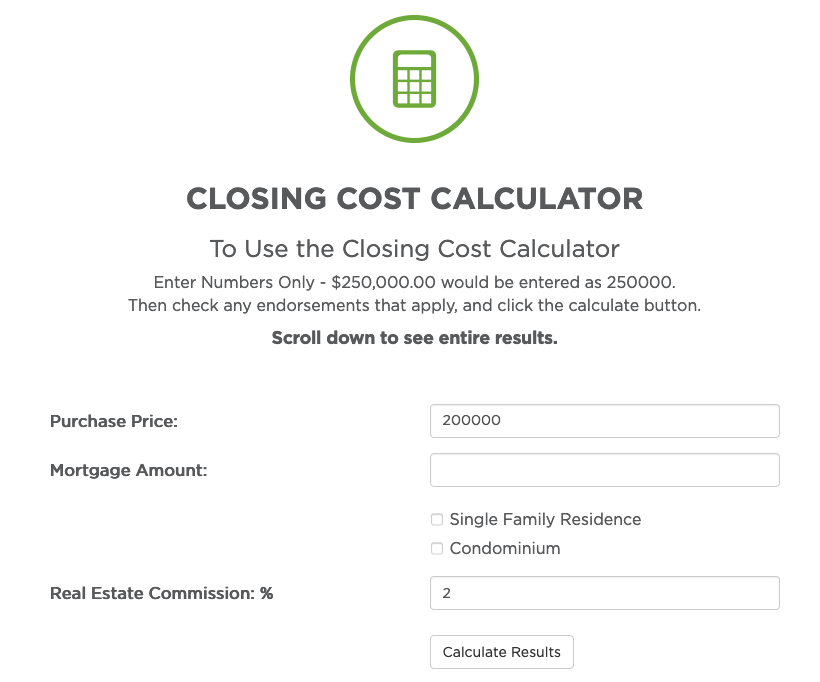

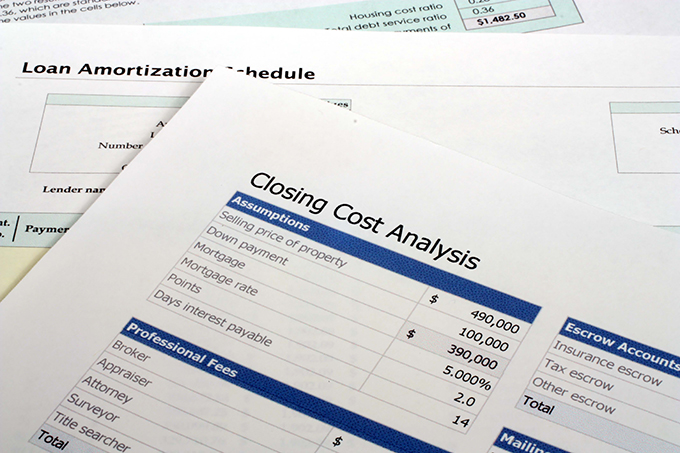

Previously the limit was 100%.The process of refinancing will follow these typical steps: On AugGinnie Mae announced they were lowering the loan-to-value limit on cash out refinancing loans to 90% LTV. Working with reputable VA lenders who are willing to break down your costs before closing can help. Obtaining Cash Out While Refinancing a VA Home Loan Loan-related costs are tied directly to your home financing and can vary quite a bit from lender to lender. Note 4 VA loans require a one-time fee called a VA funding fee which may be collected at closing or rolled into your loan. APR estimates loan fees and closing costs and determines the actual borrowing cost of a. Source: Funding Fee Table on benefits.va.gov, citing Public Law 112-56, signed November 21, 2011 The calculator interest rate includes the annual percentage rate, too. * The higher subsequent use fee does not apply to these types of loans if the Veteran's only prior use of entitlement was for a manufactured home loan. Regular Military, Reservist & National Guard Here is a mortgage rate table listing current VA loan rates available in the city of Los Angeles and around the local area.Ĭurrent VA Loan Funding Fees by Military Service Status Borrower Once you are in the active report view you can click the button to create a printer friendly version of your results. Once you are done with your calculations you can click on the button to bring up a detailed report about your loan. Please remember that this is an estimate, the actual fees and expenses may change depending on a variety of factors including the actual closing date. This is an estimate of how much you will need on the day your home purchase is made. A down payment on your VA loan may be required in certain circumstances and maximum loan limits vary by county. The fee is determined by the loan amount, your service history, and other factors. For sections that are minimized by default, please click on the dropper in the upper right section to expand them. Use this calculator to help estimate the total closing cost to purchase a home. Note 4 VA loans require a one-time fee called a VA funding fee which may be collected at closing or rolled into your loan. You can also edit any of the other variables in the calculator. Set "finance the funding fee" to No and deduct that number from your cash due at closing to get your actual closing costs.

In other caseswhen loan brokers and real estate agents are involved, for exampletotal closing.

If you were 10% or more disabled while in service, your funding fee can be waived. In some cases, closing costs can be as low as 1 or 2 of the purchase price of a property. If you do not want to finance the funding fee, then set the financing option to No. If this is an additional use rather than first time use then reset that field to reflect the higher funding fee for subsequent uses.

If you are a reservist or a member of the guard, please change this variable to reflect your funding fee.

0 kommentar(er)

0 kommentar(er)